The Open-Source Protocol Powering Lending and Borrowing of Decentralized Finance (DeFi).

Aave (AAVE) Fact Sheet

- Aave (AAVE) is a decentralized finance (DeFi) based system facilitating open-source liquidity, primarily for lending and borrowing cryptocurrencies, without the involvement of third parties or custodians.

- Aave is non-custodial and open-source and was created in 2017 under the name ETHLend before rebranding to Aave.

- Aave cryptocurrency users can earn interest by providing liquidity within the lending pools, where the borrowers get overcollateralized loans by using the liquidity from the pools.

- Any tokens deposited into the Aave DeFi platform are tokenized as aTokens, providing real-time interest.

- AAVE is the native cryptocurrency utilized on the platform. It has numerous use-cases in its utility, including governance and fee reduction, and can also be burnt from the fees collected on the protocol.

- Aave Limited is a private company owned by its founder & CEO, Stani Kulechov, headquartered in London, UK.

- Aave Limited is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 to issue electronic money to consumers and businesses. Firm Reference 900984.

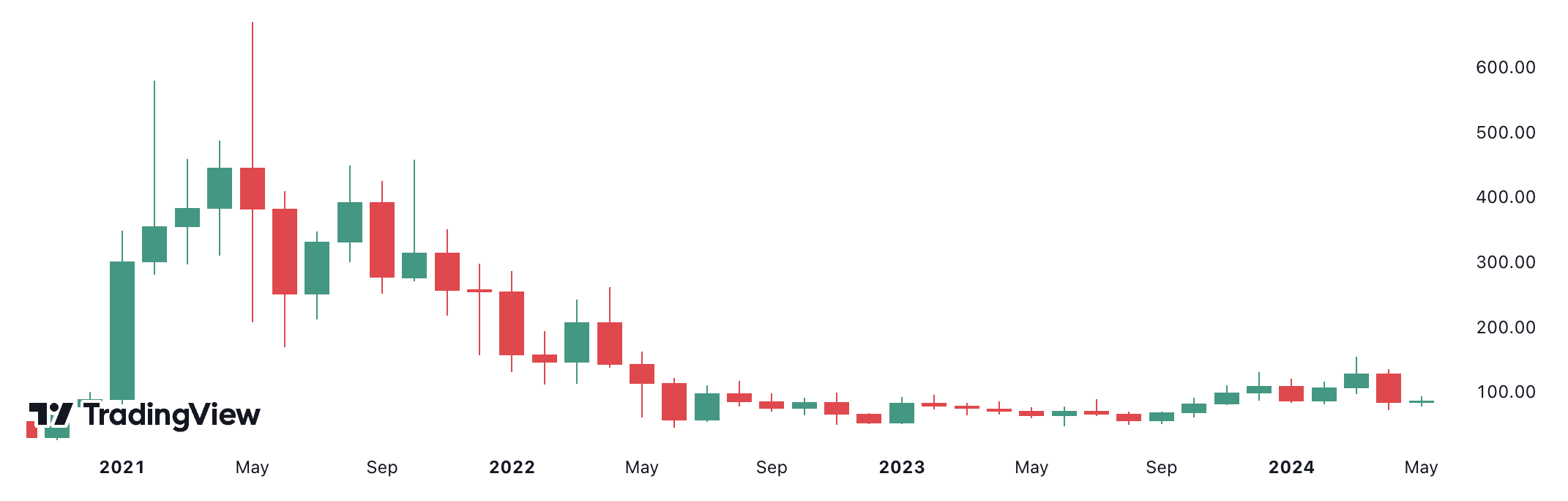

AAVE Historical Data Price Chart in the U.S. Dollars (USD)

Aave Historical Data Price Chart in the U.S. Dollars (USD). Source: TradingView

What is Aave (AAVE)?

Aave (AAVE) is a decentralized finance (DeFi) open-source liquidity sourcing protocol to earn interest, borrow assets, and build applications.

Aave is purpose-built to offer users access to cryptocurrency loans and savings accounts on a non-custodial money market involving borrowers and lenders.

Aave (AAVE) was initially created on the Ethereum (ETH) blockchain network as ETHLend and later rebranded to Aave. The name “Aave” in Finnish means "ghost," symbolizing that the protocol is fully decentralized in the way it operates.

Aave operates by enabling users to lend and borrow cryptocurrencies in a decentralized and trustless way. There are no middlemen, and users are not required to complete a Know-Your-Customer (KYC) procedure, as opposed to traditional centralized solutions.

How is Aave (AAVE) Used?

Lenders will deposit their funds into a liquidity pool; borrowers can borrow cryptocurrencies from it. Every pool sets aside a specific percentage of the asset as a reserve to help hedge against any volatility that might occur within the protocol. It also has the added benefit of allowing lenders to essentially be able to withdraw their cryptocurrencies at any point in time.

There are numerous cryptocurrencies that AAVE supports, including TUSD, DAI, USD, BUSD, BAT, ETH, LINK, MANA, REP, ENJ, ZRX, MKR, and others. However, not every cryptocurrency supported by the platform can be used as collateral when making a cryptocurrency loan.

When it comes to overcollateralized loans, a user must lock up a specific amount of collateral larger than the amount being withdrawn, typically calculated in the USD.

The collateral amount will depend on the cryptocurrency the user wants to borrow, typically from around 50% to 75%.

Suppose there comes the point in time when the collateral of a specific user falls under the required collateralization threshold, which again is calculated in USD. In that case, the funds are then posted for liquidation and can be purchased at a discount by other users across the broader Aave system.

Within a lending pool, there is a reserve. Every pool holds reserves in various cryptocurrencies, with the total amount in Ethereum (ETH) defined as the total liquidity.

The reserve accepts deposits from the lenders, and users can borrow these funds, assuming that they lock up a greater value as collateral that backs the borrowed position.

The amount that a specific person can borrow is dependent on the currencies deposited that are still available in reserve.

Every reserve will have a specific Loan-to-Value (LTV) ratio, calculated as the weighted average of the different LTVs of the collateral's currencies. The weight of each LTV is the equivalent amount of collateral in ETH. Borrow positions can be opened with a stable or variable rate, and borrows can have infinite duration with no repayment schedule.

Use-Cases of Aave (AAVE)

Numerous use-cases surround the Aave (AAVE) platform, and we will review each individually.

Aave Interest Rates Explained

There are two general interest rates offered by the Aave platform – variable and stable.

Aave variable interest rate is determined through algorithmic means, based on the utilization rate of a specific asset pool driven by demand. When there is an increase in the utilization rate of a given pool, there is a dynamic increase in the interest rates for lenders and borrowers.

Aave stable interest rates are based on a 30-day average of interest rates for a specific asset. This interest rate history is seen clearly when lending or borrowing the assets on the platform.

Any user can, at any point in time, switch between stable and variable rates. However, each switch will incur a fee on the Ethereum (ETH) network in the form of a gas fee.

The Aave aToken

Whenever funds get deposited on Aave by the lenders or collateral by the borrowers, Aave provides those users with the equivalent amount of "aTokens."

For example, if an individual decided to deposit 1,000 DAI, they would be issued 1,000 aTokens. The function of aToken is to track balances and enable the users to earn interest on their crypto balance.

A small fraction of corresponding aTokens gets added to each user's Ethereum wallet, directly responding to the APR interest rate for the specific assets. These can be exchanged for the equivalent amount of the underlying asset later. Everything is calculated when the user decides to make a withdrawal.

The Aave Flash Loan Functionality

Aave has gathered a high reputation within the crypto space due to its introduction of flash loans. Flash loan is a feature that has sparked controversy within the crypto space since it is a functionality within the Aave system that enables users to borrow large amounts of cryptocurrency without any collateral.

In a flash loan case, the borrowed cryptocurrency must be paid back by the time the next Ethereum (ETH) block gets mined. If it has not been paid back, every transaction occurring within the period gets canceled instead, and a fee is paid for every flash loan.

Now, since the asset can be borrowed for a very short amount of time, flash loans have found their way into specific use-cases, such as trading the asset elsewhere as a means of making a profit, refinancing loans in other lending protocols, or swapping the collateral that is deposited on them.

However, while numerous crypto platforms offer flash loans, Aaave stands out because the code behind the functionality was made open-source and publicly accessible by anyone, which meant that any Ethereum developer could quickly implement the functionality throughout their platform.

Governance

Another crucial role of the AAVE cryptocurrency is governance. The governance token controls the rights of the protocol.

To vote, users must hold AAVE tokens or stkAAVE (Staked Aave), or both, in which case the total amount of tokens will be used for voting.

To vote, Aave user needs to visit the “Governance” section in the application, after which they will select the relevant proposal.

Users can read through the proposal and discuss it further or select the vote they would like to cast.

For a vote to be valid, a user’s balance of voting tokens has to be the same or greater throughout the entire voting and validating period. Users can change their vote anytime, and the previous vote will be canceled automatically.

Usability & Primary Features of Aave (AAVE)

The Aave (AAVE) project has many features to offer and is evolving at a steady pace.

Protocol

Aave (AAVE) is a decentralized finance (DeFi) based system facilitating open-source liquidity, primarily for lending and borrowing cryptocurrencies, without the involvement of third parties or custodians.

The protocol is governed by the holders of the AAVE cryptocurrency – the native token fueling the project that can also be staked as a means of earning rewards on the network.

Ledger

Aave solution is built on the Ethereum (ETH) blockchain network, which has a public ledger that any blockchain explorer can view.

However, what makes Aave unique within distributed ledger technology is that it allows users to lend and borrow multiple cryptocurrencies, including stablecoins and altcoins.

The Aave protocol is interoperable with numerous decentralized finance (DeFi) platforms and aims to provide the best value for the open-source money market.

Smart-Contract Support

Since Aave is built on the Ethereum (ETH) blockchain network and has innate smart contract support.

Aave users do not need to rely on a third party or a middleman to handle their cryptocurrency – everything is automated through the smart contracts on the platform.

Tokenomics & Supply Distribution

Aave launched Aavenomics, which was introduced through a Flash Paper, a synthesis of the Aavenomics Proposal.

As ETHlend rebranded to Aave, the LEND governance cryptocurrency migrated to AAVE through a Genesis Governance vote at a rate of 100 LEND per 1 AAVE.

The total supply of AAVE is 16 million tokens, where LEND token holders could redeem 13 million AAVE tokens. The remaining 3 million AAVE tokens were allocated to the Aave Ecosystem Reserve.

Aave also announced the launch of a Safety Module (SM) for staked AAVE to act as collateral of last resort.

LEND migrated to AAVE at a rate of 100 LEND for 1 AAVE, with a supply changing from 1.3 billion LEND to 16 million AAVE.

Regarding the projected usage of the proceeds, 30% go towards core development, 20% for user experience development, 20% for management and legal, 20% for promotions and marketing, and 10% for unexpected costs.

In the initial supply distribution of Aave (AAVE) at launch, 23% went to the founders and the project, while 77% went to investors.

Team & History

The original platform, ETHLend, was founded in 2017 by Stani Kulechov with a team of developers.

The company has sustained the project development through an initial coin offering (ICO) in 2017, which raised $16.2 million.

The first version of ETHLend ran on the Ethereum (ETH) blockchain and brought various additional use-cases to smart contracts.

However, the project developed rapidly. In September 2018, ETHLend rebranded to Aave and transitioned to a peer-to-contract model, which offered swift transactions within the system and enabled instant access to funds within the liquidity pool.

In January 2020, Aave launched its money market on the Ethereum network and acquired the U.K. Financial Conduct Authority license.

Activities & Community

There are numerous activities within the Aave ecosystem, and the project has a large community. Specifically, on its Twitter page, Aave has over 475,800 followers as of July 2022.

Development Activity and GitHub Repositories

Aave announced V3 on March 16, 2022, following its initial introduction and whitepaper in November 2021 – the more potent version of the Aave Protocol, which introduced new features ranging from increased capital efficiency to enhanced overall decentralization of the project.

Aave introduced the Portals that can facilitate cross-chain transactions, a high-efficiency model that can unlock higher borrowing power, and an isolation mode that allows for new assets to be listed while also protecting the protocol.

Gas optimizations were introduced, reducing gas costs across all functions by 20% to 25%.

Aave also introduced L2 designs for specific Layer-2 networks and risk management that provided additional protection throughout various risk caps and other tools.

All enhancements of the Aave Protocol are listed in the Aave V3 Technical Paper published by Emilion Frangella and Lesse Herskind.

Aave GitHub repositories have five central pinned repositories, including:

- aave-v3-core

- aave-v3-periphery

- governance-crosschain-bridges

- Interface

- governance-v2

The aave-v3-core repository has 11 contributors and received 263 stars and 137 forks.

The aave-v3-core contains smart contracts source codes and market configuration for the Aave Protocol V3. The repository also uses Docker Compose and Hardhat as its development environment for compilation, testing, and deployment tasks.

Activities and Partners

Since its launch, Aave has formed numerous partnerships with like-minded projects.

- MakerDAO - MakerDAO is in active partnership with Aave. Due to periods of high demand in DeFi, there have been spikes in stablecoins borrowing rates due to the traders covering positions. As such, DAI was minted and supplied over Aave to decrease the interest rates and to keep their prices appealing.

- HexTrust - HexTrust is an institutional gateway to DeFi and digital assets partnered with Aave. It’s an open-source and non-custodial liquidity protocol where the integration enables institutional investors to safely and securely hold the tokens in the HexTrust licensed and insured platform with a high level of security.

- Balancer AMM DeFi Protocol - Balancer Protocol partnered up with Aave to release a hybrid liquidity-and-lending feature aimed at increasing the capital efficiency of Balancer to a greater extent.

References & Reports

References

- Aavenomics

- Decentralizing Aave

- ETHlend Announces Launch of New Parent Company ‘Aave’ - Cision

- DeFi giant Aave (LEND) rallies 40% after receiving UK FCA approval - Cointelegraph

- Aave FAQs Page - Governance Explained

- Aave_Protocol_Whitepaper_v1_0.pdf

- Aave Official Website

- Messari Aave (AAVE) Token Distribution

- Aave Twitter Page

- Introducing Aave V3

- Aave_V3_Technical_Paper.pdf

- Aave Github

- Aave V3 Core Github

- MakerDAO

- HexTrust

- Balancer

- Decentralized finance - Wikipedia

- Know-Your-Customer (KYC) Explained - Wikipedia

Market Reports

\