An Ever-Evolving Decentralized Exchange and Governance Token.

dYdX (DYDX) Fact Sheet

- dYdX is a decentralized exchange (DEX) that supports numerous types of trading options and features DYDX governance token cryptocurrency.

- dYdX exchange and its cryptocurrency, the DYDX token, are built on the Ethereum blockchain network with smart contract functionality support.

- dYdX is a product of dYdX Trading, Inc. - a private company established in 2017 and headquartered in San Francisco, CA, USA.

- The DYDX cryptocurrency follows the ERC-20 token standard established by Ethereum.

- On the dYdX DEX, users can engage in perpetual, margin, and spot trading, lending, borrowing, and many other financial trading activities.

- The dYdX protocol was initially founded in July of 2017 by Antonio Juliano.

- dYdX works towards building its own blockchain, based on Cosmos SDK.

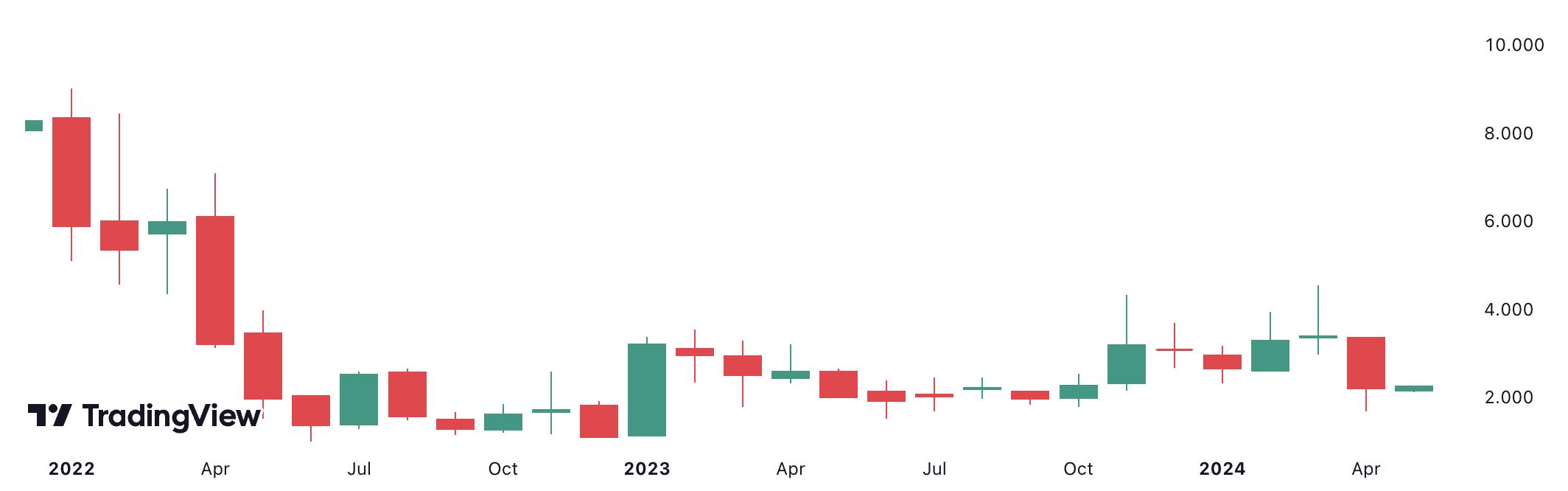

DYDX Historical Data Price Chart in U.S. Dollars (USD)

DYDX Historical Data Price Chart in U.S. Dollars (USD). Source: TradingView

What is dYdX (DYDX)?

dYdX is a decentralized exchange (DEX) that allows people to engage in numerous decentralized finance (DeFi) activities powered by the Ethereum (ETH) blockchain technology. The protocol also enables users to lend, borrow, and make bets on the future price of crypto assets.

The idea and the goal of the dYdX DEX are to provide trading tools commonly found throughout traditional markets, such as Forex and stocks, in a blockchain-based environment.

DYDX cryptocurrency is a governance token for the Layer-2 protocol of the dYdX DEX. It serves the role of facilitating the operation of Layer-2 and, in turn, enables traders, liquidity providers, and partners to contribute to the future proposals of the protocol.

The DYDX is a governance token that lets the dYdX community govern the Layer-2 protocol. It enables shared control, allowing traders, liquidity providers, and partners to work collectively toward an enhanced protocol.

Holders of DYDX and stkDYDX gain governance power in two ways – proposing and voting. Users can view their propositions through the dashboard, and voting powers are provided with the option to delegate them to other addresses.

For someone to participate in the DYDX on-chain governance, they need to have or be delegated DYDX tokens. They also need Ether (ETH) to cover potential transaction costs. Once this is completed, to cast votes, users need to navigate to the proposal’s page, after which they can select an active proposal.

However, token holders can also delegate their tokens to a wallet address by going to dydx.community/dashboard, selecting "Delegate," and choosing the type of power they want to delegate. Afterward, they can enter a wallet address for a third party. Note that delegating authority does not transfer the tokens.

This method enables a robust ecosystem surrounding governance, rewarding, and staking, all of which are designed to drive the growth and decentralization of the DEX and provide a better user experience for everyone involved.

There are also staking pools specifically designed to promote liquidity and safety on the dYdX protocol featuring rewards programs for trading, liquidity providing, and historical usage of dYdX.

How is dYdX (DYDX) Used?

dYdX (DYDX) is a decentralized exchange (DEX) utilized for margin trading, perpetual trading, lending, borrowing, and other decentralized finance (DeFi) activities.

Margin trading consists of borrowing money through which investors can make much larger bets on the price movement of a specific crypto asset or asset pair, such as Bitcoin (BTC) to USD.

Traders and investors can bet on the price of the cryptocurrency moving in a specific direction, either up or down. Then they can execute their trades on the exchange's spot market, which has no leverage, or by using margin.

Margin trading on the dYdX exchange can essentially allow cryptocurrency traders to increase their profit potential if they choose the right outcome; however, they also increase their chance of losses if the market goes against the overall prediction.

There's mandatory collateral in DeFi protocol as proof of funds a specific trader or investor has. In DeFI lending and borrowing, both provided by the dYdX DEX, collateral represents the minimum deposit required to be taken out and repaid within a loan. The more collateral is deposited, the more a trader can borrow.

Furthermore, users of dYdX DEX can engage in Perpetual Futures Trading – the synthetic trading markets that enable users’ exposure to liquid assets by using stablecoins as collateral.

The process of perpetual trading allows traders to participate in market movements, reduce risk, and make a profit through logging or shorting with leverage on a futures contract.

A futures contract is a representation of a derivative contract – a type of contract that derives its value from the performance of the underlying asset. A perpetual contract is a specialized type of futures contract with no expiration date, so the traders can hold their position open for as long as they want to.

Regarding the usage of dYdX, it offers decentralized peer-to-peer (P2P) shorting, lending, derivatives trading, and many other trading activities through Ethereum-based tokens.

However, the dYdX DEX takes things further by introducing decentralized services, such as short selling, that allow investors to profit on the price decreases and can be used for speculation or to hedge existing positions. It also offers full-collateralized and low-risk loans for short-sellers, allowing token holders to get interest through the fees.

Regarding its security, dYdX is non-custodial, meaning that the exchange does not hold any funds and that users control their funds at all times. Furthermore, dYdX is regularly audited by Peckshield, OpenZeppelin, and Bramah Systems.

If someone wants to trade margin on the dYdX DEX, they need to select their position, select the position size, select their leverage, and open the margined position.

dYdX DEX supports two kinds of margin trades – an isolated margin, associated with a specific portion of an asset, and a cross margin, which utilizes the entire dYdX margin account.

Another key component of the DYDX cryptocurrency is the discount it provides on trading fees. Specifically, users who hold DYDX or stkDYDX can receive a trading fee discount based on the size of their current holdings. For example, if they have a balance of 100 DYDX + stkDYDX, they can receive a 3.0% discount. At 200,000, they can get a 30.0% discount, and at over 5,000,000, they can receive a 50,0% discount which is the maximum.

Use-Cases of dYdX (DYDX)

dYdX is a cryptocurrency exchange that aims to unite advanced financial tools in a decentralized manner. The dYdX platform supports margin trading, so the investors can increase their overall exposure to specific cryptocurrencies by utilizing leverage.

That said, dYdX features an isolated margin, letting users assign specific funds within an account as a part of a given trade. Then there's also cross-margin, which utilizes all of the assets a trader might keep within the platform.

Then there are perpetual, a type of futures contract that does not have a pre-specified selling date.

Users who deposit funds on their dYdX account start automatically earning interest because the assets are entered into a global lending pool specific to each cryptocurrency.

The dYdX platform also aims to guarantee security for lenders by ensuring that the borrowers have enough collateral in their accounts at any time.

This method also allows dYdX borrowers to instantly gain access to any asset available on the platform by using funds in their possession as collateral for the loan.

With the launch of Layer-2, the dYdX DEX introduced many features popular with the traders:

- With low fees and no Ethereum-associated gas costs, users are no longer required to pay miners for every transaction on the network.

- Trades are executed instantly and confirmed on the blockchain within hours.

- There is no waiting period or requirement to withdraw funds.

- The exchange is redesigned from the ground up to be accessed on any device, such as mobiles and tablets.

- StarkWare, as a Layer-2 solution, provides increased security and privacy through the zero-knowledge rollup implementation.

- dYdX users can access leverage across positions in multiple markets from any account.

Usability & Primary Features of dYdX (DYDX)

Numerous security, usability, and quality-of-life features make dYdX stand out from other Layer-2 DEX exchanges.

Protocol

While dYdX was initially built on the Ethereum blockchain tech, it did launch its own Layer-2 scaling infrastructure.

The primary role that the DYDX cryptocurrency serves is as a governance token. The holders of the DYDX cryptocurrency are given the right to essentially propose and vote on global changes that can potentially get added to dYdX Layer-2 and can also profit through the cryptocurrency by staking it or through the trading fee discounts they get by utilizing it.

dYdX Layer-2 is built on Starkware’s StarkEx scalability engine. It is primarily utilized for the process of trading cross-margined perpetual. StarkEx is a scaling solution that enables dYdX to increase its overall transaction speed, eliminate gas costs, and reduce trading fees. It also allows a lower minimum trade size on the protocol.

StarkEx scalability engine for crypto exchanges utilizes the power of cryptographic proofs to attest to the validity of a batch of transactions. It then updates a commitment to the state of the exchange on-chain.

This technology enables exchanges such as dYdX to provide non-custodial trading at a significant scale, with high liquidity and low cost.

dYdX Layer-2 increases the overall scalability of the platform by using a zero-knowledge rollup technology, zkSNARKS.

The technology works by receiving proofs while validating a batch of the transactions off-chain, which are then sent back to the blockchain, where a smart contract verifies them. zkSNARKS makes it possible to remove the expensive computation requirements from the mainnet without sacrificing any decentralization.

Ledger

dYdX features an order book architecture, commonly found on centralized exchanges. The order book model leads to a more efficient functionality and is less capital intensive because it requires fewer funds to achieve the same level of liquidity.

Smart-Contract Support

dYdX has full support for smart contracts – it’s a project that runs through the utilization of smart contracts on the Ethereum blockchain and allows users to trade with no intermediaries on the platform.

Tokenomics & Supply Distribution

On August 4, 2021, dYdX announced the DYDX cryptocurrency governance token launch.

The total supply of the DYDX cryptocurrency is 1 billion tokens. However, most tokens are vested and planned to become accessible over five years gradually.

Specifically, after five years, dYdX will implement a perpetual inflation rate of 2% throughout every following year to ensure that there will always be enough DYDX available to reward the community.

In regards to the allocation, 5% goes to the community treasury, 2.5% to the safety staking pool, 2.5% to the liquidity staking pool, 7.5% as liquidity provider rewards, 7.5% as retroactive rewards, 25% to user trading rewards, 27.7% for investors, 15.3% for employees and consultants of dYdX Trading or Foundation, and 7.0% for future employees and consultants of dYdX Trading or Foundation.

Token Allocation Chart. Source: dYdX Community

DYDX token holders are given the opportunity and right to propose and vote on the Layer-2 protocol, where they can determine the allocation of the community treasury funds or even vote for new token listings and change any risk parameters.

Furthermore, from July 14, 2026, dYdX governance can decide the maximum supply of new tokens to be minted, up to the maximum inflation rate of 2% per year at each mint.

Team & History

dYdX initially launched in 2017, and since its time on the market, it has developed a strong reputation and has cemented itself as one of the most long-supported DEXs out there.

The core team behind the dYdX project are:

- Antonio Juliano - The Founder and CEO of dYdX.

- Lucas W – The CTO and lead Software Engineer at dYdX.

- Corey Miller – A Growth and Investments lead at dYdX.

- David Gogel – The Growth Lead at dYdX.

- Paul Erlanger – The Business Operations and Growth at dYdX.

- Marc Boiron – The General Counsel at dYdX.

Activities & Community

Regarding the community surrounding dYdX, the official dYdX Twitter for DEX has over 239k followers. Furthermore, the official dYdX Discord channel has over 15,600 members.

Development Activity and GitHub Repositories

One of the essential developments currently happening to dYdX is the announcement of dYdX v4, which aims for complete decentralization.

As announced on January 11, 2022, dYdX V4 is planned to launch by the end of 2022 and aims to be fully decentralized with no central components. The mission of the development team is to create its own blockchain network.

On June 22, 2022, dYdX announced the development of the dYdX Chain – a standalone blockchain based on the Cosmos SDK and the Tendermint Proof-of-Stake consensus protocol.

dYdX v4 will feature a fully decentralized, off-chain order book and a matching engine capable of significant scaling.

Cosmos SDK is the technology that makes it easy to create a standalone blockchain through strong cross-chain capabilities. Cosmos-powered chains are based on the Tendermint proof-of-stake systems, which results in high throughput, decentralization, and customizability.

All of the dYdX V4 code will be open-source, which means that everyone will be able to run it on the permissionless network, and no services will be run directly by dYdX Trading Inc.

The core dYdX v4 node will be the software that validators and node providers will run. It will be built on the Cosmos SDK, and the core node will run consensus, off-chain order book, and matching as well as all transaction types, such as deposit, transfer, withdrawal, price oracles, and other core systems.

dYdX GitHub repositories include 6 popular projects:

- Liquidator

- Solo

- Protocol_v1

- Dydx-v3-python

- Perpetual

- Dydx-python

However, some of them are deprecated. As dYdX is moving to v4, most of them will likely shift over time.

References & Reports

References

- dYdX Exchange

- dYdX Trading, Inc. - Crunchbase

- ERC-20 token standard - Ethereum

- Decentralized Exchange (DEX) - Wikipedia

- Governance Token - Everipedia

- Safety Staking stkDYDX

- Perpetual Futures Trading - Wikipedia

- Futures Contract - Wikipedia

- Peer-to-Peer (P2P) - Wikipedia

- Short Selling - Investopedia

- Peckshield

- OpenZeppelin

- Bramah Systems

- Gas and fees - Ethereum

- StarkWare

- StarkEx Scalability Engine

- zkSNARKS

- Introducing DYDX Token

- Vesting - Wikipedia

- dYdX Community

- Official dYdX Twitter

- Official dYdX Discord

- Announcing dYdX Chain

- dYdX V4 Roadmap - Full Decentralization

- Tendermint Proof-of-Stake consensus protocol

- Open-source - Wikipedia

- dYdX GitHub repositories

Market Research

- DYDX Historical Data Price Chart in U.S. Dollars (USD)

- DYDX Token Allocation Chart

- dYdX Total Value Locked and Stats - DeFi Lama

\